Member Retirement

As you begin winding down a successful and fulfilling CPA career, you may choose to keep your designation(s) active long into retirement. All members are subject to the same annual requirements, but as a retiree you may meet criteria for exemptions from the Annual Membership Dues (AMD) and/or Continuing Professional Development (CPD) and receive free CPD courses.

How to maintain membership through your retirement years

To remain a CPA Ontario member in good standing, be sure to complete your annual AMD/CPD obligations, even if you are retired, between April 1-June 1 of each year through My Portal.

If you qualify for an exemption, due to retirement, you will need to submit it annually between April 1-June 1 of each year through My Portal as part of your AMD/CPD application. Annually, be sure to carefully review your circumstances, to determine if you meet the criteria below.

If you are recently retired, update your employment details online at My Portal within 30 days of any change.

Annual Membership Dues (AMD) exemption

You may select an exemption from AMD based on retirement if on April 1 of the year AMD is due you qualify under one of the following categories:

- you are 65 years of age or older, and have been granted retired member status in another provincial body or a recognized professional accounting body and have been a member in good standing with CPA Ontario for at least one year

- you are 55 years of age or older and the sum of your age and the total years of membership in CPA Ontario (or a legacy body, provincial bodies or a recognized professional accounting body) equals or exceeds 70, and your projected gross annual income from all employment, director’s fees and net income from self-employment (excluding employment insurance, pension income, investment income, support payments, and disability income) is not greater than CDN$25,000

- you have retired-member status in another provincial body or a recognized professional accounting body and have been a member in good standing with CPA Ontario for 15 continuous years

- you have been granted retired-member status with CPA Ontario before July 2, 2014

Life members recognized by CPA Ontario Council are automatically exempted from AMD.

For full details on AMD exemptions, refer to Regulation 11-1.

Continuing Professional Development (CPD) exemption

The CPD requirements set out in Regulation 7-2 have been updated for reporting years beginning January 1, 2022 (the reporting year is the calendar year for which the CPD activities are required). Refer to our Simple Guide to CPD Requirements for more information.

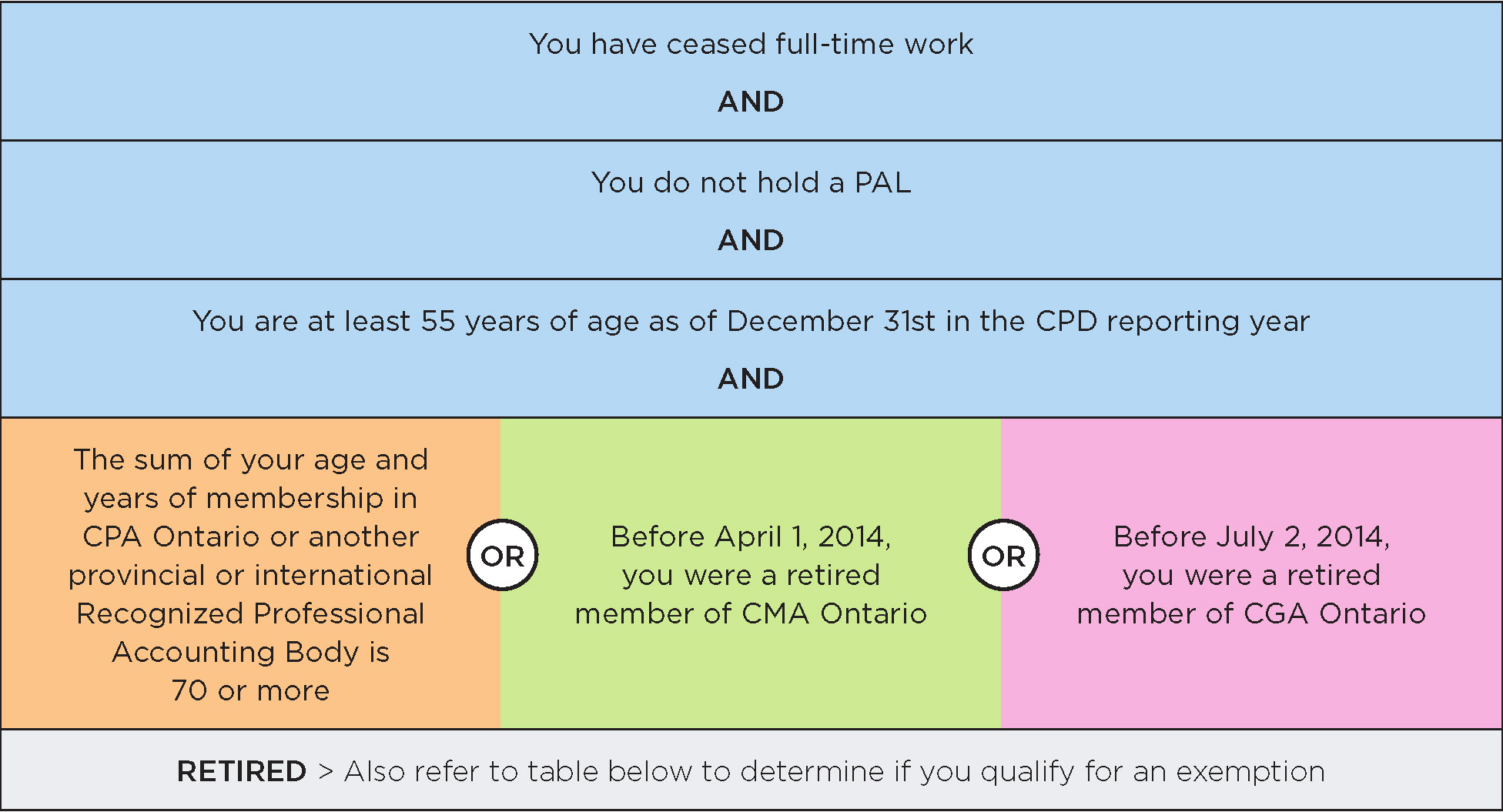

To file a retirement CPD exemption, you must:

- meet the definition of retired

- and

- must not have provided any Reliance Services in the reporting year

Do you meet the definition of retired?

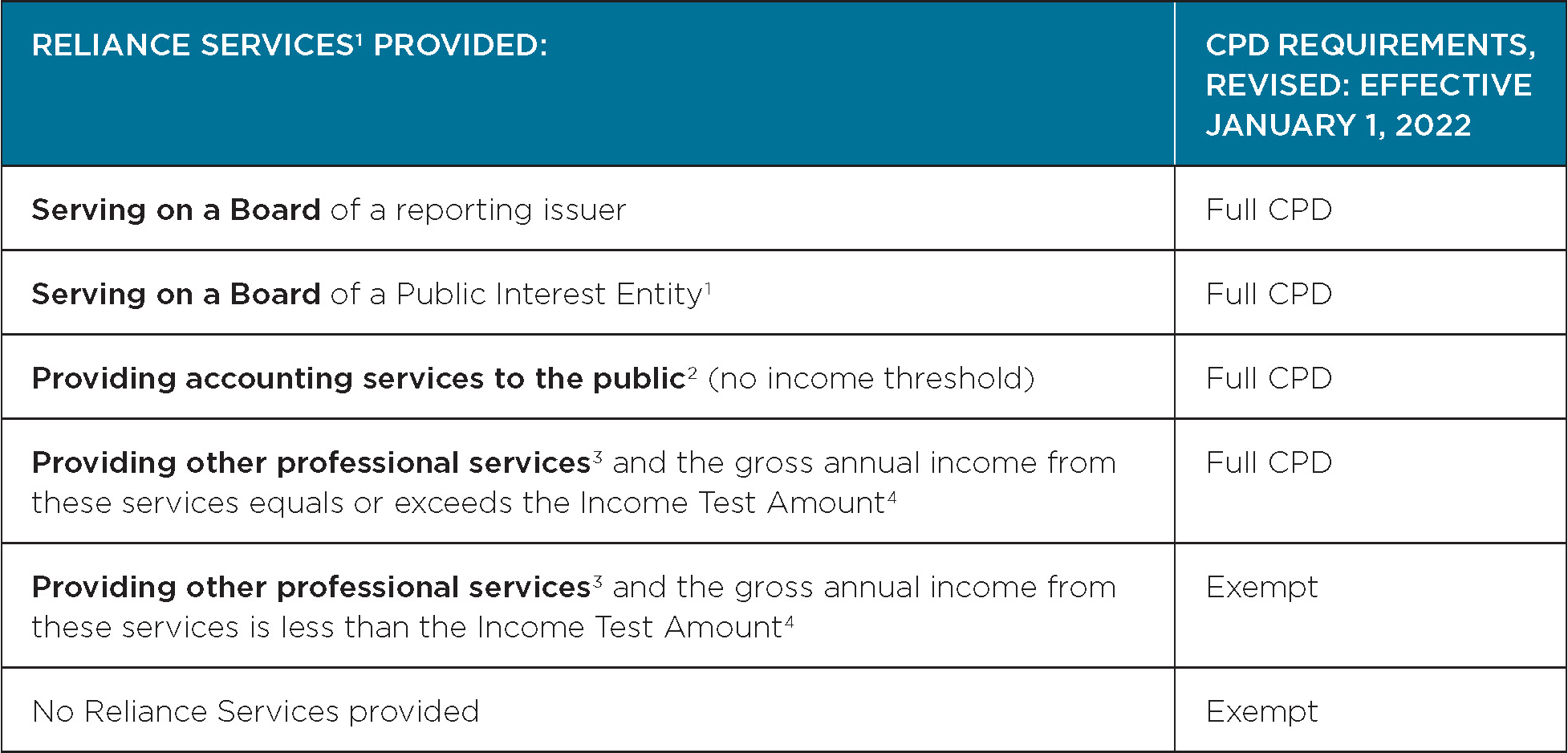

Have you provided Reliance Services?

“Reliance Services” means activity undertaken by a member during the relevant reporting year where it is reasonable to believe that another party is relying on the member’s skills as a chartered professional accountant.

- 1 As defined in Regulation 7-2 Continuing Professional Development

- 2 As defined in By-law 1.1.53

- 3 Professional services as defined in the preamble to the CPA Code of Professional Conduct

- 4 Income Test Amount is adjusted annually and published on the CPA Ontario website.

- 2024-25 Income Test: $46,000

- 2025-26 Income Test: $46,800

Many retired CPAs continue to play an important role in the governance of boards, and board membership often offers continuing professional development opportunities. If you have any questions or concerns about the new CPD requirements for retired members, our membership team is here to help. If you require support in determining how to maintain your membership in light of these changes, please contact the Registrar's Office directly to discuss your circumstances. For further details on CPD exemptions, refer to Regulation 7-2.

Coming out of retirement?

Refresh your skills with CPD that is relevant to your practice or profession and be prepared to meet the full AMD/CPD requirements in the year that you return to work.

Log in to My Portal to update your employment details.

Member resignation

A retired member is still an active member and has access to all the rights, responsibilities and benefits of membership, including the use of the CPA designation. If your preference is to no longer maintain your membership and CPA designation, upon retirement, you can apply to resign. Find more information here.

Closing your registered firm

If you plan to close your practice, follow our guide for closing a firm which outlines requirements and how to plan and effectively communicate an exit strategy.

Life Membership

The Council may name any Member in Good Standing a Life Member, if the Member:

- is a past chair of CPA Ontario

- has rendered conspicuous service to CPA Ontario or

- has attained 70 years of age at the beginning of the financial year in which the Member is considered for life membership and has completed a minimum of 40 years of membership in an organization that regulates chartered professional accountants incorporated in any province or territory of Canada

Life Membership is a distinction, and new Life Members receive a certificate in recognition of their commitment to the accounting profession.

Life Members are exempted from AMD.

Life Membership does not exempt members from the CPD requirement. Members who are practising public accounting, serving on a board, or providing other reliance services will still be required to complete the annual and triennial CPD requirements. Please refer to our Simple Guide to CPD Requirements for more information.

Free CPA Ontario CPD offerings for retired members

A retired member is eligible to register for up to three full days of CPA Ontario CPD courses each year without being required to pay the registration fee if they:

- are not licensed as a public accountant

- do not provide any Professional Services for which they are remunerated

- do not receive remuneration, such as directors’ fees, for serving on the board of a Public Interest Entity or governing body of a reporting issuer

If you are retired and meet the eligibility criteria required to register for free course(s), please email Professional Development to identify the course(s) you wish to attend. You will receive an email within five business days confirming or denying your request. You may also call 1 800 387.0735 for more information.