Continuing Professional Development

Continuing Professional Development (CPD) helps CPAs remain current with the latest business trends, evolve their skills and remain go-to resources for companies and organizations in any industry. CPD is a requirement to maintain membership.

The mandatory CPD requirements for members of CPA Ontario have been aligned with the International Federation of Accountants’ CPD standards and harmonized with the provincial CPA bodies.

CPAs must complete at least 120 hours of CPD in every rolling three-year period and submit a CPD Declaration each year. On this page you will find information on how to submit your annual CPD declaration and learn more about your CPD requirements.

A Simple Guide to CPD Requirements

All CPD must:

- be relevant to your professional responsibilities and competencies as a CPA

- be quantifiable, meaning it’s able to be expressed in terms of a specific time requirement

- contain significant intellectual or practical content

- pertain to activities directly related to the competencies needed to engage in the practice of public accounting, if you are applying for or renewing a Public Accounting Licence

Read more about the requirements in Regulation 7-2.

As required under Rule 203 of the CPA Code of Professional Conduct, "A member shall sustain professional competence by keeping informed of, and complying with, developments in professional standards in all functions in which the member provides professional services or is relied upon because of the member’s calling".

In order to comply with Rule 203, a member may need to complete more than the minimum CPD requirement in Regulation 7-2.

CPD – at a glance

Annual Requirement (January 1-December 31)

Every year: You must complete a minimum of 20 hours of CPD (including 10 verifiable hours).

CPD Declaration (April 1-June 1)

You must submit your CPD Declaration for the reporting year (previous calendar year) at the same time you pay your Annual Membership Dues (AMD) by completing the AMD/CPD application in My Portal.

Triennial Requirement

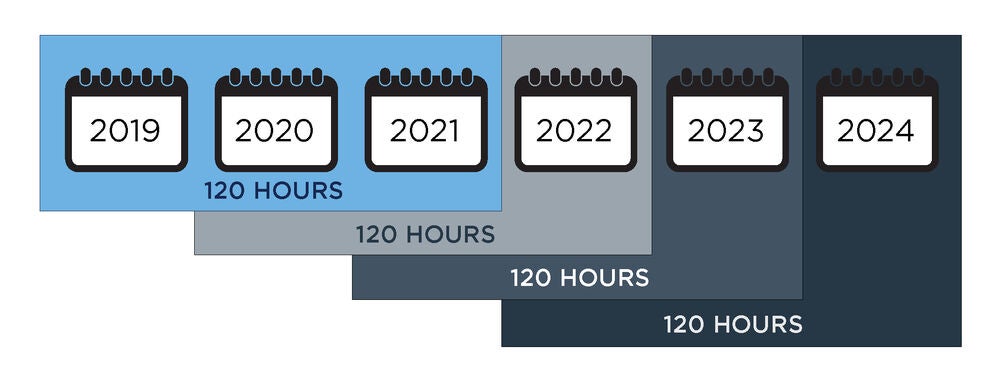

Every rolling three-year period: You must complete 120 hours of CPD (including 60 verifiable hours, four of which are related to professional ethics).

Submitting your annual CPD declaration

You must submit a CPD Declaration each year for the reporting year (previous calendar year) as part of your AMD/CPD application submission.Between April 1-June 1 each year, you must log in to My Portal to complete your AMD/CPD application which includes the CPD Declaration. If you are a Life Member and are exempt from AMD, you will find the CPD Declaration under the AMD/CPD application.

The deadline to submit your CPD declaration is June 1. A late fee of $25 is applied to submissions received after June 1. Members with outstanding declarations after June 30 will be subject to suspension.

To submit your CPD declaration, log in to My Portal and select Annual Obligations ► AMD/CPD tile ► Complete Now.

Your annual and triennial CPD requirements

You are required to complete a minimum of 20 hours per year and a total of 120 hours by the end of each triennial period (e.g. 2021-2023, 2022-2024, 2023-2025, etc.).

Annual Requirements (January 1-December 31 of reporting year (previous calendar year):

- minimum of 20 hours, 50 per cent (or 10 hours) of which must be verifiable

- minimum of 120 hours, 50 per cent (or 60 hours) of which must be verifiable

- must include four verifiable hours of professional ethics

Verifiable CPD hours

At least 50 per cent of your CPD hours must be verifiable. Hours are considered verifiable if you have acceptable documentation to support the professional development hours. You must keep records and supporting documents of these activities for at least five years in case you are audited.

Verifiable hours can be gained through continuing education, instruction/speaking, technical committees and research/publications. For further details on what qualifies as verifiable hours and acceptable documentation, see A Simple Guide to CPD Requirements.

Unverifiable CPD hours

You obtain unverifiable hours through independent and informal learning activities. These activities can include:

- on-the-job training for new software or techniques

- self-study that does not involve an exam

- casual reading of journals and magazines

Professional ethics CPD requirement

Professional ethics is the study of the values that guide the choices and behaviours of professionals. Professional ethics CPD can cover a wide range of topics related to ethics.

Your four required ethics hours do not have to be obtained in one single program. They can be accumulated through ethics components in any number of seminars or courses. Course material must go beyond a mere awareness of the rules, standards or guidelines. It should give examples or scenarios that show applications of ethical decision-making and present ethical dilemmas.

Read more about the ethics requirement in our Simple Guide to CPD Requirements.

Tracking your CPD hours

To help record, update and track your CPD hours, you can use our optional CPD Tracker. Remember to retain all related documentation for five years.

The CPD Tracker is for your personal record-keeping purposes and does not exempt members from a CPD Audit. CPA Ontario does not have access to your CPD Tracker. Courses taken through CPA Ontario are not automatically populated in your CPD Tracker and will need to be added manually.

If you are selected for audit, you will need to enter all required details through the CPD Audit log on My Portal. Review our page on CPD and AMD Audits for more information.

CPD exemptions

Some members may qualify for an exemption of the CPD requirements, such as retired members and those who are unemployed or on leave.

Between April 1-June 1, you can apply for a CPD exemption for the reporting year (previous calendar year) as part of your AMD/CPD application submission via My Portal. All exemptions must be applied for annually.

Retired members must also apply annually for an exemption. Find out more details on our Retirement page.

You may qualify for an exemption if you did not work or provide any professional services for six months or more in the reporting year (previous calendar year) as a result of:

- Unemployment

- Maternity/Parenting/Family Care Leave

- Medical Leave

Extraordinary Circumstances exemptions are only available when no other exemptions are appropriate, but you experienced extraordinary circumstances that impaired your livelihood or ability to practice. This exemption requires detailed information and special consideration by the Registrar before it can be approved. You must upload supporting documentation, such as a letter explaining your circumstances, when you select the exemption through My Portal.

Review specific qualification information in our CPD exemptions FAQs.

All exemptions are subject to CPD audit. You are required to retain documents for up to five years. Review our page on CPD and AMD Audits for more information.

Do Not Comply (Plan of Action)

If you do not meet your CPD requirements, you must submit an online Plan of Action within 14 days of completing your annual obligations requirement. The Plan of Action shows that you agree to complete the missing minimum verifiable and unverifiable CPD requirements.

The Plan of Action allows you an additional 120 days to complete the missing CPD hours. You must declare via My Portal that you have fulfilled your obligations when you have completed the plan.

CPD requirements for new members

Former CPA Ontario students who have been admitted to membership during the CPD reporting year:

- on or before September 30 of the reporting year, must complete the full CPD requirements in the year of admission,

- or

- after September 30 of the reporting year are exempt from CPD for the year of admission only

New members admitted under any other pathway (for example, via provincial transfer or mutual recognition agreement with an international accounting body) must complete full CPD in the year of admission.

New members’ first triennial period will be the first three years of membership. As with other exemptions, if you claimed an exemption for any year in the triennial period, your overall hours will be pro-rated.

Members are cautioned that the selection of an exemption or declaration of non-compliance may impact your ability to renew a Public Accounting Licence (PAL). To be eligible to renew a PAL, members must complete CPD hours directly related to the competencies needed to engage in the practice of public accounting.

Members applying for a PAL are required to demonstrate compliance with the requirements set out in Regulation 7-2 as part of the application.

CPD Requirements for Public Accounting Licences (PAL)

PAL holders and members applying for a PAL must undertake CPD activities directly related to the competencies needed to engage in the practice of public accounting, as set out in International Education Standard 8 (IES 8), Professional Competence For Engagement Partners Responsible For Audits Of Financial Statements (Revised). Please note hours in taxation (e.g., annual personal and corporate tax updates) do not count towards CPD for licensure, unless they meet the learning outcomes identified in IES 8.