Take these steps now

Step 1 - Create a profile

Stay connected and learn more about becoming a CPA. Get access to exclusive networking events for internationally educated professionals that will prepare you for the job market in Ontario. Get access now.

Step 2 - Learn more about your pathway

Join us for a CPA information session to learn how to become a CPA.

Need more personalized information after attending an information session? Register for a one-on-one advisement with a CPA advisor to discuss your pathway options.

Step 3 - Transcript assessment

Your next step is to evaluate how your credentials and education are recognized in Canada.

If you have a qualification from a post-secondary institution outside Canada, you must request an International Credential Advantage Package (ICAP) course-by-course evaluation carried out by World Education Services (WES). A WES evaluation ensures the authenticity of international documents and provides a consistent Canadian equivalency determination for international credentials.

Why do I need a transcript assessment?

Transcripts are evaluated to determine whether you meet the degree requirement and have completed the required subject area coverage (academic pre-requisites) for entry to the CPA Professional Education Program. CPA Ontario will use the transcript assessment results to advise you on the path and courses required to obtain a CPA designation.

Submit my transcript

Step 4 - Register as a student and complete your education and practical experience requirements

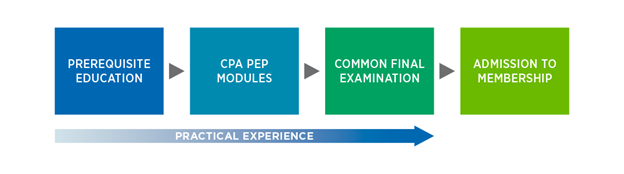

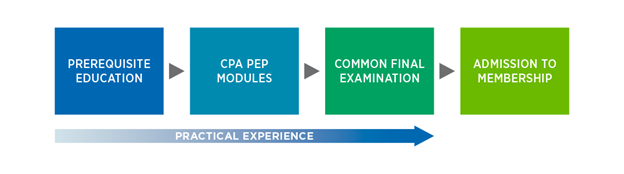

The nationally developed and provincially delivered CPA certification program consists of:

- academic prerequisites with specific subject area coverage

- the CPA Professional Education Program (PEP), which includes the Common Final Examination (CFE)

- thirty months of recognized, relevant practical experience