Sustainability Reporting: The Big Picture for CPAs

November, 2023

Global climate change and biodiversity agreements have highlighted the financial risks and opportunities that companies face due to their environmental and social impacts, and, as a result, corporate sustainability reporting is taking center stage.

As the demand for sustainability-related disclosures continues to increase and regulatory requirements evolve, CPAs will be called upon to support investor-grade sustainability information.

How did it all start? Where did this focus on sustainability come from?

The United Nation’s Intergovernmental Panel on Climate Change (IPCC)’s Fifth Assessment Report in 2014 found that human activity is causing climate change and is driving the loss of ecosystems. The report makes clear that greenhouse gas (GHG) emissions have risen sharply since pre-industrial times, and GHG levels are now at their highest concentrations in at least the last 800,000 years.

According to the UN’s Fifth Assessment Report the changing climate threatens our physical systems (glaciers, oceans, atmosphere), biological systems (plants, wildlife, ecosystems on land and in water) and human systems (societies, cultures and economies). Prolonged disruption to the climate exacerbates biodiversity decline which further erodes critical “natural capital” that businesses rely on for inputs, operations and markets.

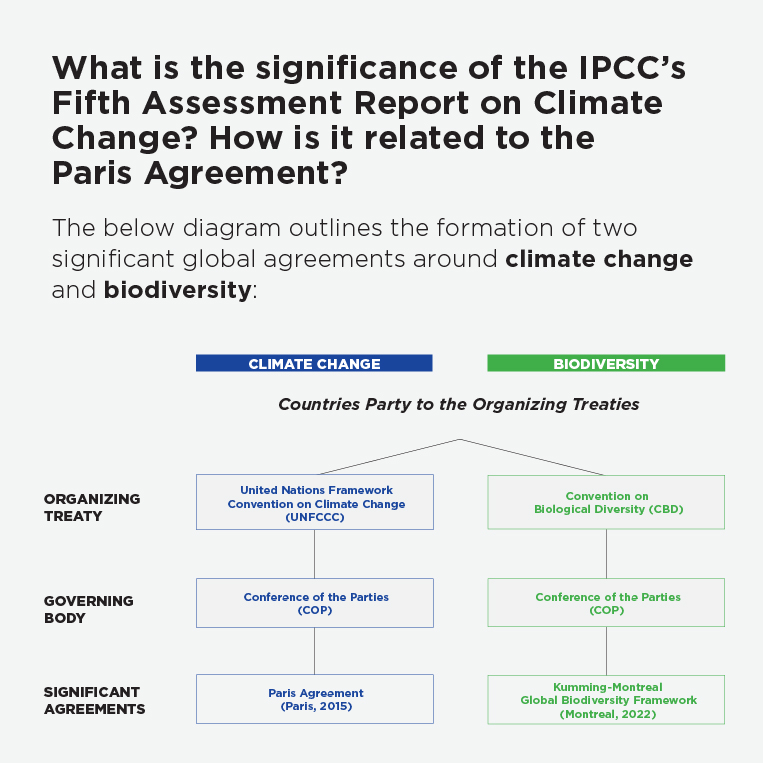

What is the significance of the IPCC’s Fifth Assessment Report on Climate Change? How is it related to the Paris Agreement?

The below diagram outlines the formation of two significant global agreements around climate change and biodiversity:

- The IPCC report set the stage for the 2015 Paris Conference of the Parties (COP) 21, the decision-making body for climate change under the UN Framework Convention on Climate Change. The COP meets annually to discuss progress in addressing climate change.

- The 196 countries at COP21 adopted the legally binding Paris Agreement to reach net-zero emissions by 2050 and limit global warming to well below 2°C and preferably 1.5°C compared to pre-industrial levels by the end of the 21st century.

- The Paris Agreement established Nationally Determined Contribution (NDC), which is a commitment to reduce GHG emissions. The Agreement also established that parties shall communicate their NDCs every 5 years, and each successive NDC will represent a progression beyond the previous one.

- As a party to the Paris Agreement, Canada is legally bound to meet its NDC and achieve net-zero by 2050.

The Paris Agreement is for climate change, what about nature and biodiversity?

- Like the UNFCCC, the Convention on Biodiversity (CBD) has a Conference of Parties (COP) governing body that has met since 1994 to monitor progress on biodiversity conservation.

- The most recent COP, COP15 in 2022 held in Montreal led to the Kunming-Montreal Global Biodiversity Framework, akin to the Paris Agreement for biodiversity.

- The Framework aims to halt biodiversity loss, restore ecosystems, protect indigenous rights and recognizes nature’s role in limiting global warming to 1.5°C.

- One of the commitments in the Framework is to halt and reverse nature loss, which includes putting 30% of land and oceans under protection by 2030.

- Canada as a party to the Framework, has stated goals of protecting 30% of land and waters by 2030, and includes a clear path to protecting 25% of its oceans and land by 2025. The plan includes major investments in Indigenous-led conservation initiatives to help reach that 30% target.

- Recent research from PwC identified that more than half (55%) of the world’s gross domestic product (GDP) is moderately or highly dependent on nature. The report also found that of all 163 sectors analyzed have at least a portion of their value chain that is highly dependent on nature.

How does sustainability reporting fit into this big picture?

- The finance sector sees the writing on the wall. Capital no longer remains passively indifferent in the face of sustainability-related challenges and opportunities.

- The bottom line on future business viability requires top line clarity on sustainability.

- Just as capital providers have relied on financial reporting to gain insight into the financial health of a company, they are looking for similar disclosure about the sustainability of a company’s business operations.

- While many companies are voluntarily disclosing sustainability-related information, reporting still lacks a consistent framework/standard to make them comparable and consistent for users.

- That's why standard setters and regulators are moving at unprecedented speed. From the International Sustainability Standards Board (ISSB) releasing the first set of International Financial Reporting Standards (IFRS) Sustainability Standards, S1 and S2, or Europe’s Corporate Sustainability Reporting Directive (CSRD) regulation, sustainability standards and regulations are coming fast.

How can sustainability risks materialise into financial impacts?

- Failure to properly account for and manage sustainability data could result in regulatory, reputational, competitive and market risks that all feed into higher costs, lower revenues, higher capital costs and eroded enterprise value over the short and long-terms.

- Consider some illustrative examples of how sustainability risks can materialise into financial risks:

Greenhouse Gases (GHG)

- The Paris Agreement legally obligates signed countries (including Canada) to reach net-zero emissions by 2050. Common mechanisms used to manage carbon emissions and get to net zero are:

- a carbon tax and

- a cap-and-trade system.

- A carbon tax is a set price per ton of greenhouse gas emissions that increases over time.

- A cap-and-trade system caps total emissions at a certain level and issues tradeable allowances that decline over time. Companies below their allowance levels can sell excess allowances to companies that are above their allowance.

- While carbon taxes have fixed pricing for a set duration, cap-and-trade allowance prices fluctuate based on supply and demand dynamics. Both systems incentivize emission reductions on a shrinking timeline to net-zero.

- Therefore, the disclosure of a company's greenhouse gas emissions would serve to indicate specific sustainability-related financial risks and opportunities associated with a company's emissions.

- Companies with high emissions and no reduction plans expose themselves to financial risks. A company's lack of mitigation strategy exposes it to immediate risks from existing carbon pricing regimes like a carbon tax or cap and trade system. Disclosure of carbon emissions is useful information for capital providers to assess both current future sustainability-related financial risks and opportunities associated with the company.

- GHG disclosures generally cover 3 categories: Scope 1 (direct emissions from owned or controlled sources), Scope 2 (indirect emissions from purchased electricity) and Scope 3 (all other emissions in a company's upstream and downstream value chain).

- While Scope 1 and 2 emission-related risks and opportunities fall within a company's control, Scope 3 generally does not. However, Scope 3 emissions remain relevant as upstream and downstream risks and opportunities in the value chain can transfer through the value chain to the company.

Biodiversity

- The Kunning-Montreal Global Biodiversity Framework, although it is not legally binding, commits signed countries (including Canada) to protect 30% of land and water by 2030. As a party to the Framework, Canada committed to protecting 30% of its land and water by 2030.

- For companies that directly depend on natural resources or ecosystem services expose themselves to financial risk because of these commitments. As particular lands and water resources are protected, resource extraction, infrastructure construction or other land development plans may now face restricted access, higher costs, potential project delays or cancellations and in some cases legal liabilities related to existing environmental damage caused by a company's operations.

- Disclosure of nature-related risks is useful information for capital providers to assess both current and future sustainability-related financial risks and opportunities.

Human Capital

- Millennials and Gen Z increasingly favour purpose-driven employers, so companies perceived as lagging on sustainability could face a brain drain.

- A recent survey by Deloitte found that 55% of millennials and Gen Z research a company's environmental impact and policies before accepting a job, and more than 40% say they have already, or plan to changes jobs due to climate concerns.

- Companies slow to respond to these shifting demands of the younger workforce risk significant employee turnover, which in turn carries financial costs for recruitment, onboarding and training of replacements which according to a Gallup study can range from 50% to 200% of the departing employee's salary, not even considering lost productivity, and lost business relationships.

Where do CPAs fit in?

By providing investors and capital providers with the information they need to make key decisions, sustainability reporting and assurance are natural extensions of financial reporting. The core competencies of risk assessment, professional skepticism, problem solving and decision-making place CPAs at the forefront of supporting sustainability reporting and assurance.

For more information, read our article: Why Should CPAs Care About Sustainability?

Where to learn more about sustainability reporting standards and regulations

To learn more about sustainability reporting standards and regulations, be sure to visit the following pages regularly:

Opportunities in Sustainability: Climate Reporting

Hear from a panel of experts on the opportunities for CPAs in Climate Reporting. Join us January 30 and earn 1 PD hour.