Canada Sustainability Reporting Regulation

Canadian regulators are paying more attention to businesses’ sustainability reporting.

The Office of the Superintendent of Financial Institutions (OSFI) issued its final Guideline B-15, Climate Risk Management in March 2023.

The Canadian Securities Administrator (CSA) issued its proposed draft climate-related disclosure (NI 51-107) rule in October 2021.

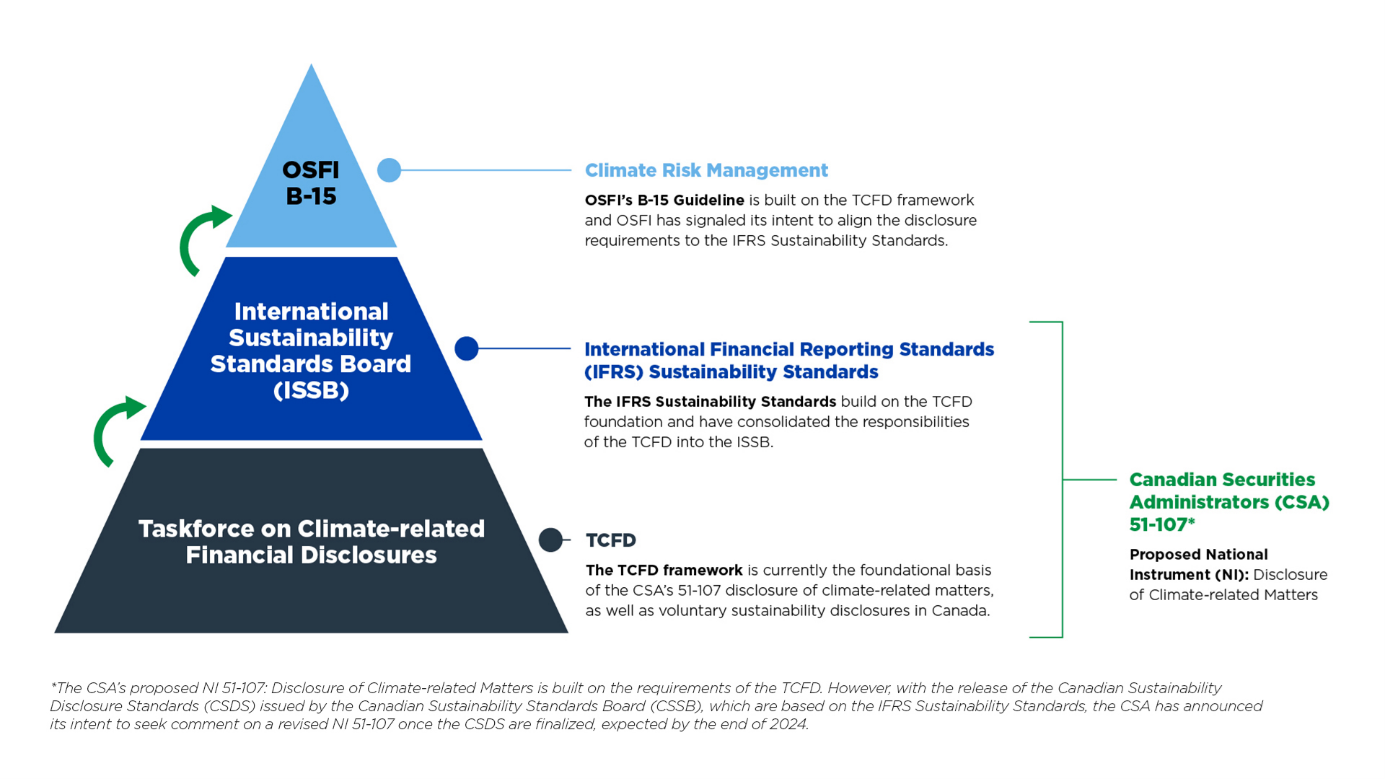

The good news for Canadian companies is the current and proposed sustainability reporting requirements are built on the Taskforce on Climate-related Financial Disclosures (TCFD) foundation, which forms the basis for many voluntary reports, as can be seen in the illustration below.

Who’s impacted?

CSA NI 51-107: Venture and non-venture issuers

OSFI Guideline B-15: All federally regulated financial institutions, except foreign bank branches

What’s the latest?

CSA: In December 2024, the CSA confirmed its intention to publish a revised rule for public comment that would consider the Canadian Sustainability Standards Board’s (CSSB) standards.

However, on April 23, 2025, the CSA announced it is pausing its work on developing a new mandatory climate-related disclosure rule to support Canadian markets and issuers in adapting to the economic uncertainty due to recent developments in the U.S. and globally. The CSA will monitor domestic and international regulatory changes and revisit the climate-related disclosure project to finalize requirements in the future.

OSFI: On March 7, 2025, OSFI updated its Guideline B-15 on climate-related disclosures. Key revisions to Chapter 2, Annex 2-2 include the implementation date for disclosing Scope 3 greenhouse gas emissions to align with the CSSB standards, now set for fiscal year 2028. In addition, OSFI announced it will hold a consultation later in the year on the disclosure expectations of greenhouse gas emissions from off-balance sheet assets under management.

What do Canadian CPAs need to know?

OSFI’s climate-related regulation, B-15 is already in force. Certain federally regulated financial institutions with fiscal periods ending on or after October 1, 2024, have already began reporting.

It is not just companies that are regulated by the OSFI that will be impacted. These regulations may require certain disclosures pertaining to the regulated entity’s value chain, which means companies that sit within the value chain of a regulated entity may be asked to provide information to the regulated entity. Refer to our article, Why Businesses Can’t Ignore Sustainability for more information.

Where can I learn more?

For more information, please refer to our At a Glance: Sustainability Reporting Standards and Regulations and related FAQs.

You can also refer to:

CSA Announcement, December 18, 2024

CSA Announcement, April 23, 2025

OSFI’s Letter to Industry – We are Updating Guideline B-15 for the Final CSSB Standards