2025 Ontario Budget: Highlights & Takeaways

May 16, 2025

On May 15, 2025, the Hon. Peter Bethlenfalvy, Ontario's Minister of Finance, presented the government’s 2025 budget: A Plan to Protect Ontario.

Released against the backdrop of unpredictable U.S. trade policy, this budget arrives at a key moment for Ontario’s economy, and the province’s relationship with its most important trading partner.

While A Plan to Protect Ontario includes new measures intended to address crime, improve healthcare, and build infrastructure, the overwhelming focus, and the rationale for its weakening fiscal position, is on mitigating the impact of tariffs.

Worsening Economic Outlook

The budget indicates a worsening economic outlook for Ontario compared to last year's projections (see table 1). Tariffs and trade tensions are contributing to forecasts of lower real GDP growth and a higher unemployment rate. For 2025 and 2026, GDP growth projections are more than halved relative to last year’s budget. During these two years, the unemployment rate is expected to be approximately one percentage point higher than previously anticipated.

The housing sector is also underperforming compared to previous forecasts. The 2025 budget anticipates a significant reduction in construction activity, with housing starts decreasing by approximately 17,800 units on average per year through 2027.

Table 1: Key Economic Data: Budget 2025 vs Budget 2024

Real GDP | ||||

|

Budget 2025 | 1.5 | 0.8 | 1.0 | 1.9 |

|

Budget 2024 | 0.3 | 1.9 | 2.2 | 2.2 |

Consumer Price Index | ||||

|

Budget 2025 | 2.4 | 2.3 | 2.0 | 2.0 |

|

Budget 2024 | 2.6 | 2.0 | 2.0 | 2.0 |

Unemployment rate | ||||

|

Budget 2025 | 7.0 | 7.6 | 7.3 | 6.6 |

|

Budget 2024 | 6.7 | 6.6 | 6.4 | 6.2 |

Housing starts (000s) | ||||

|

Budget 2025 | 74.6 | 71.8 | 74.8 | 82.5 |

|

Budget 2024 | 87.9 | 92.3 | 94.4 | 95.8 |

Weakening Fiscal Position

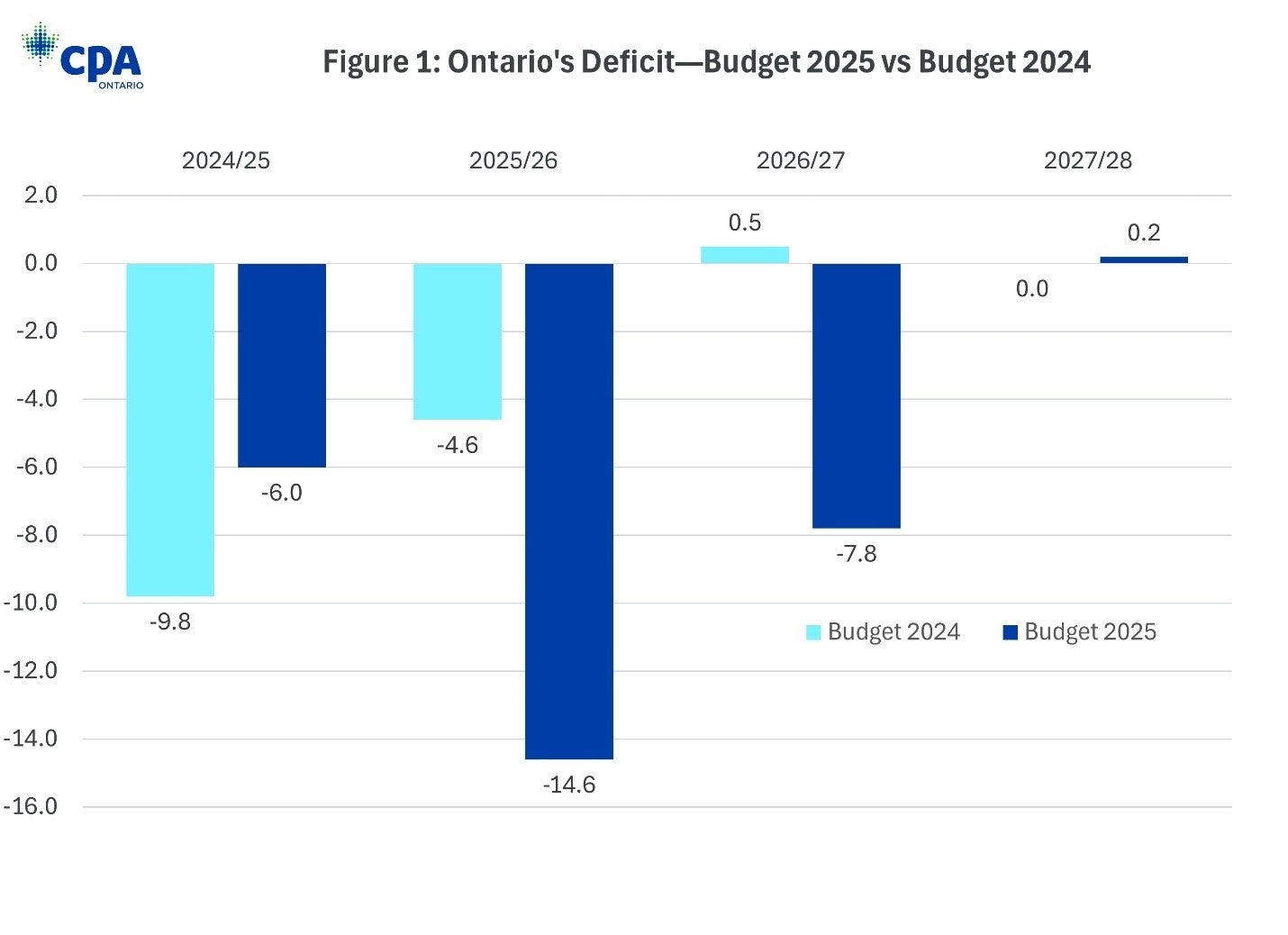

While last year’s deficit improved from $9.8 billion to $6.0 billion, Ontario’s fiscal position is expected to weaken starting this year and beyond, with the deficit growing in size and the target for a balanced budget delayed by one year to 2027/28 (see figure 1).

The 2025 budget projects total spending of $232.5 billion for the 2025/26 fiscal year, which includes a $2 billion reserve for contingencies. Total revenue is expected to reach $219.9 billion, resulting in a projected deficit of $14.6 billion—a significant increase from the $4.6 billion deficit forecasted in the 2024 budget.

This larger deficit is primarily driven by an $11.9 billion increase in spending, including $1.5 billion for higher debt servicing costs and an additional $500 million allocated to the reserve as a prudence measure. These spending increases are partially offset by $2.5 billion in higher revenues (see table 2).

Table 2: Ontario Fiscal Data for 2025/26—Budget 2025 vs. Budget 2024 (Billions $)

|

Total revenues | 219.9 | 217.4 | 2.5 |

|

Program spending | 216.3 | 205.8 | 10.5 |

|

Debt charges | 16.2 | 14.7 | 1.5 |

|

Total spending | 232.5 | 220.6 | 11.9 |

|

Reserve | 2.0 | 1.5 | 0.5 |

|

Surplus/deficit | -14.6 | -4.6 | -10.0 |

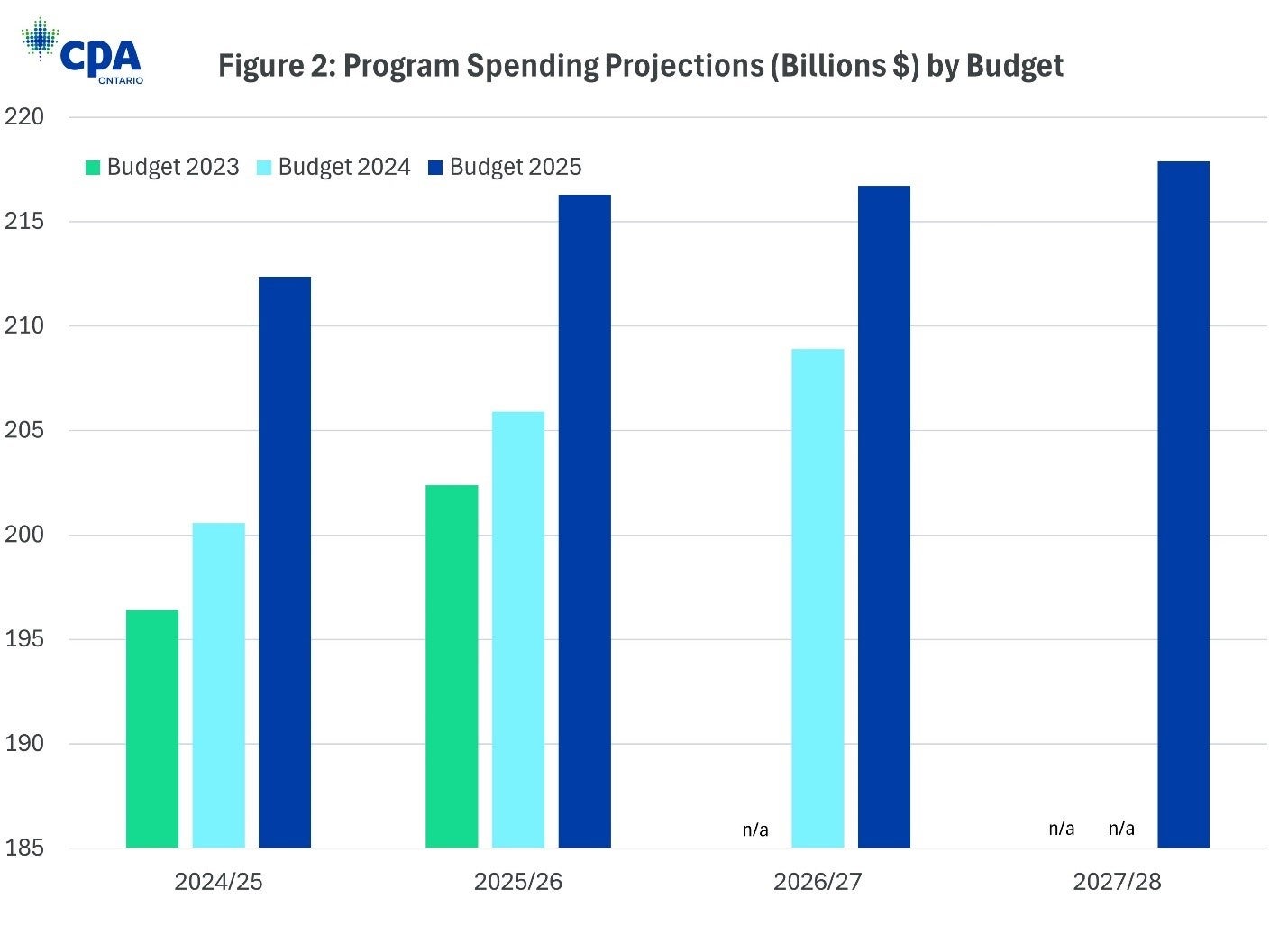

Notably, the 2025 budget continues a trend for the Ontario government, where planned program spending tends to increase with each successive budget (see figure 2).

Looking ahead, the government forecasts a $7.8 billion deficit in 2026/27, followed by a modest $200 million surplus in 2027/28.

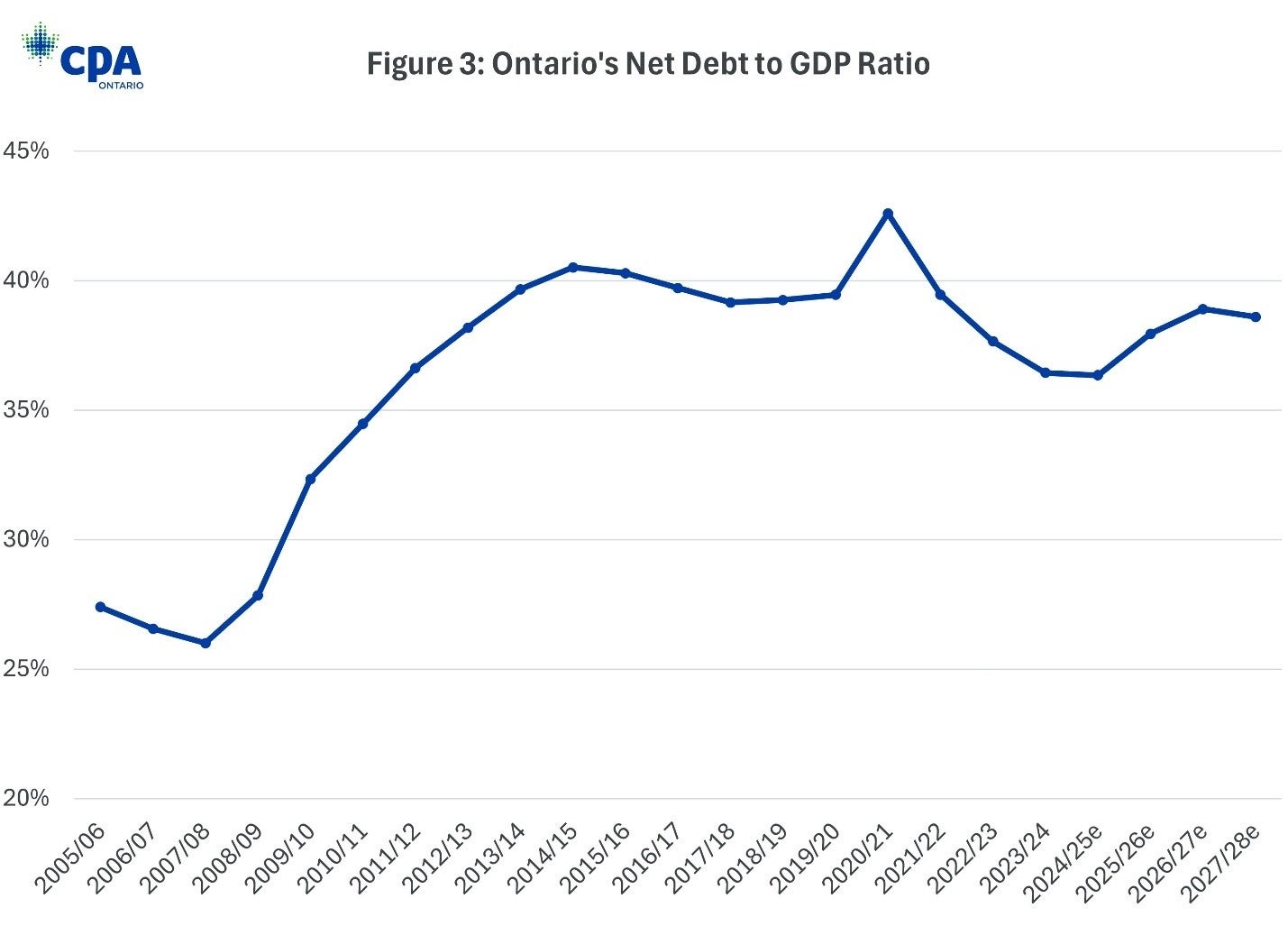

Due to annual deficits combined with debt-financed capital expenditures, net debt over the fiscal plan grows from $428.1 billion in 2024/25 to $502.1 billion in 2027/28. As a share of GDP, net debt remains below the government’s self-imposed target of 40% but increases from 36.4% to 38.6% over the same period.

To put Ontario’s debt burden into recent historical context, consider that the net debt to GDP ratio over the planning period is lower than when the Ford government initially took office back in 2018. However, when compared to the pre financial crisis level, Ontario’s net debt remains at much higher level—by at least 10 percentage points (see figure 3).

Debt charges continue to be the fourth single largest spending item in the budget at $16.2 billion, followed by post-secondary education at $13.0 billion. The three largest are: health care ($91.1 billion), education ($41.0 billion), and children, community, and social services ($20.4 billion).

Tariff Response

Relief for Businesses and Workers

A central story of the 2025 budget is the government’s support for workers and businesses in response to U.S. tariffs, with new government spending going towards relief programs.

One of the cornerstones of its plan is the new Protecting Ontario Account (POA), a $5 billion fund that will work in tandem with federal government supports to provide up to $1 billion in immediate liquidity relief as an “emergency backstop.” The government also signaled that it would leverage the POA to make $4 billion in funding available for relief programs on an “as needed basis.”

An additional $40 million in grants will be provided for communities and local industries impacted by the tariffs through a new Trade-Impacted Communities Program (TICP). According to the 2025 budget, the funding will begin in 2025/26, with eligibility extended to municipal governments, economic development organizations, business accelerators, and industry associations.

These new initiatives build on previously announced measures, including approximately $11 billion in relief through the deferral of select provincially administered taxes, and the issuance of a further $2 billion rebate through the Workplace Safety and Insurance Board (WSIB).

The government is also augmenting pre-existing programs to provide additional support. The Ontario Made Manufacturing Investment Tax Credit has been enhanced to provide an additional $1.3 billion in support over three years. Eligibility expands to non-Canadian-Controlled Private Corporations (including publicly traded companies) as a non-refundable tax credit. The rate will increase from 10% to 15% on up to $20 million of eligible expenditures per year, increasing the annual maximum tax credit from $2 million to $3 million. Given the U.S. tariff impact on the automotive sector specifically, the government is also extending the Ontario Automotive Modernization Program (O-AMP) and the Ontario Vehicle Innovation Network (OVIN), with additional support totalling $85 million.

In addition to its raft of business focused supports, the government is targeting impacted workers by increasing the Skills Development Fund by $1 billion over the next three years, with $20 million for new training and support centres, providing referrals to in-demand training, job search assistance, upskilling, and Employment Ontario programs.

A Critical Time for Critical Minerals

The economic and geopolitical significance of critical minerals has garnered considerable attention recently, and the Ontario government continues to promote the Ring of Fire as a nationally strategic project. Along with a re-commitment to building an all-season road and other necessary infrastructure, the budget announced a $500 million Critical Mineral Processing Fund to provide financial support for projects that boost the province’s processing capacity within the critical mineral supply chain.

The government’s plan for the Ring of Fire also includes strengthening partnerships with Indigenous communities. The 2025 budget relaunches the Aboriginal Loan Guarantee Program (ALGP) as a new $3 billion Indigenous Opportunities Financing Program (IOFP), and adds $70 million over four years to the Indigenous Participation Fund.

Reducing Interprovincial Trade Barriers

While not a budget initiative, the government’s plan to strengthen Ontario’s economic resilience involves working collaboratively with provincial and federal counterparts to eliminate interprovincial trade barriers—evidenced by Memorandums of Understanding signed with Nova Scotia, New Brunswick, and Manitoba. On April 16, the government announced its intention to further—and unconditionally—advance free trade and labour mobility within Canada through the Protect Ontario through Free Trade within Canada Act.

Defence and Border Security

The Trump administration has signaled that defence spending and border security will be central to future trade discussions. While these areas typically fall under federal jurisdiction, Ontario’s 2025 budget introduces measures aligned with these priorities. This includes a $57 million investment in two new H-135 helicopters for the Niagara and Windsor police services, and $200 million for a new Ontario Shipbuilding Grant Program to support skills training, equipment purchases, and infrastructure. The grant is positioned to bolster Canada’s shipbuilding capacity under the federal National Shipbuilding Strategy and help meet the country’s 2% NATO defense spending target.

Other Highlights for CPAs

In addition to tariff relief measures, the 2025 budget includes other initiatives, tax changes, and regulatory changes of interest to CPAs.

Cost relief measures: Key initiatives including making the gas tax cut of 5.7 cents per litre and the fuel tax rate cut of 5.3 cents per litre permanent (an annual cost to the treasury of approximately $1.3 billion), and removal of Tolls on Highway 407 East following legislation banning new road tolls on any public roadway in Ontario.

Alcohol tax changes: The 2025 budget includes several tax relief measures related to the alcohol sector (totalling $155 million per year), which can be found in the document under the Annex: Details of Tax Measures and Other Legislative Initiatives.

Tax Credit for Shortline Railways: The government is proposing a 50% refundable corporate income tax credit for qualifying shortline railways to help fund track maintenance and rehabilitation expenditures, providing a total of $8 million per year in income tax support.

Fertility Treatment Tax Credit: The 2025 budget provides more detail on the government’s previously announced tax credit, which would provide support of 25% on eligible fertility treatment expenses up to $20,000, for a maximum of $5,000 a year, and include IVF cycles, fertility drugs, egg and embryo freezing and diagnostic testing. The average annual cost of this tax credit is just over $50 million.

Venture capital: The government is providing an additional $90 million in venture capital through Venture Ontario, including $50 million to VCs focused on technologies that support national defence and related technologies such as AI and cybersecurity, and $40 million to VC funds that support life sciences and biomanufacturers.

Infrastructure investment: The government took the opportunity to reiterate its capital plan of $200 billion over the next 10 years, including key projects such as Highway 413, and the Highway 401 Tunnel Expressway.

Action on short selling: The province is backing new rules from the Ontario Securities Commission (OSC) and the Canadian Investment Regulatory Organization (CIRO) to crack down on short selling with the aim to prevent price manipulation and protect smaller companies, especially in the mining sector.

Investor protection: The government is introducing legislative amendments to empower CIRO with statutory authority to compel evidence in investigations and disciplinary hearings and is increasing the maximum amounts for administrative monetary penalties certain fine to $5 million and $10 million.

Conclusion

The response to President Trump’s tariffs that carried the government through the election in February has continued to serve the foundation of its third mandate. Whether the government’s plan will be enough to blunt the impact of tariffs on the province’s economy, and its finances, only time will tell.